At Threshold, we prioritize secure and timely payments to the property owners and operators who participate in our program. A key part of this process is verifying ownership before any payments are processed. This step ensures that funds are directed to the correct parties, eliminates the risk of fraud, and keeps our program running smoothly.

Ownership verification is a straightforward process, but it requires property owners and operators to provide complete and accurate information. Missing or incorrect details can lead to delays, which is why we take extra steps to confirm ownership before payments are approved. In this blog, we’ll walk through exactly how we verify ownership and what property owners and operators need to do to avoid payment issues.

“Our program guidelines are for the protection of our property owners and operators,” says Property Account Specialist Peggy Mangum. “Verifying ownership ensures that payments are going to the right people, eliminating risk and keeping the program running smoothly.”

Verifying ownership ensures secure and timely payments, making the leasing process smooth for property owners and tenants.

The HOM, Inc. Landlord Packet

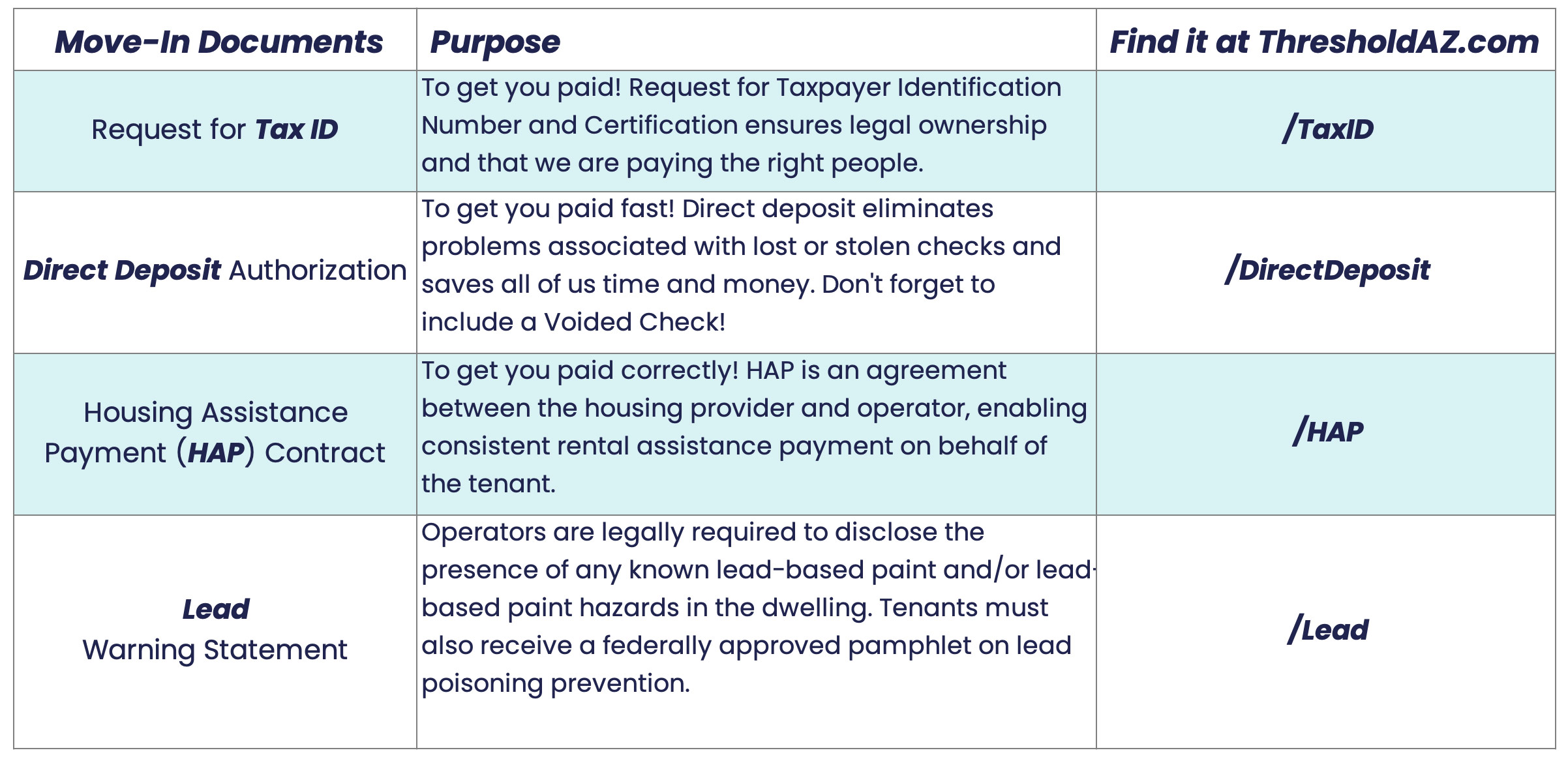

Before ownership can be verified, property owners and operators must submit a completed HOM, Inc. Landlord Packet. The packet includes:

- Landlord Overview

- Request for Tenancy Approval (RFTA)

- Lead Warning Statement

- Home Quality Standards (HQS) Inspection Tip Sheet

- Request for Taxpayer ID

- Direct Deposit (ACH) Authorization

- Sample Housing Assistance Payments (HAP) Contract

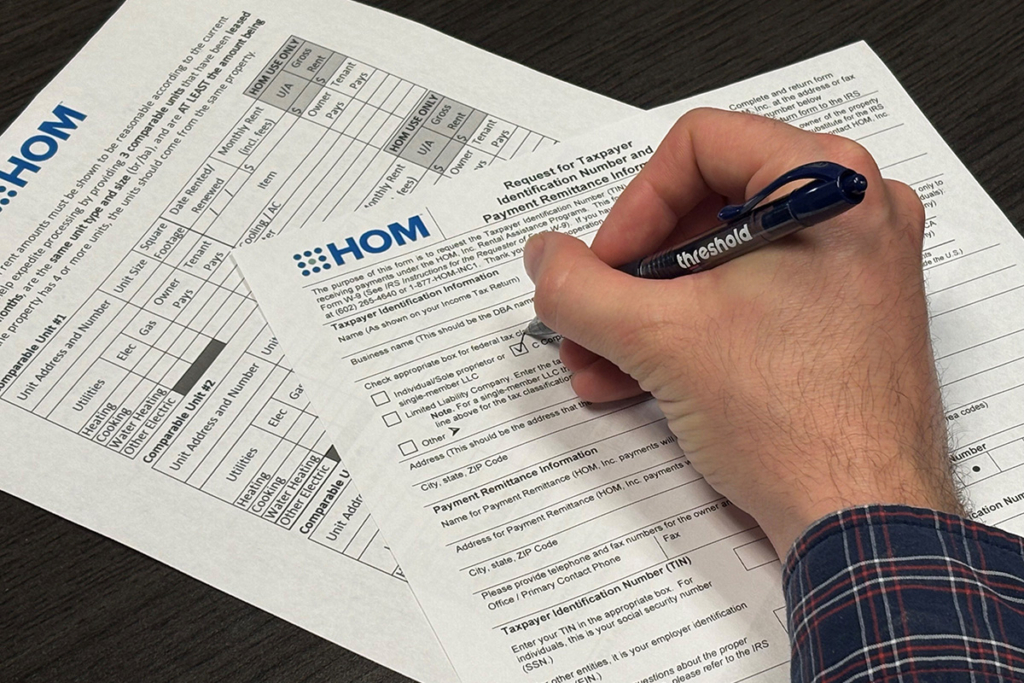

The most important documents for ownership verification are the Request for Taxpayer ID Form and the Direct Deposit Authorization.

Request for Taxpayer ID Form

This form must be fully completed and signed, including:

- Taxpayer identification details (name, business name, tax classification).

- Payment remittance information (who will receive payments and where).

- Social Security Number (SSN) or Employer Identification Number (EIN).

- A signature and date at the bottom of the form.

W-9 Form

For owners using a property management company, a signed Property Management Agreement and a W-9 are also required. These forms must be signed and dated to be valid. Missing or incomplete forms can delay the verification process, which in turn delays payments.

Once landlords submit these documents, our Landlord Support Team verifies the information to ensure it matches official property records before processing payments.

Setting Up Direct Deposit for Payments

To avoid delays in receiving payments, property owners and operators are encouraged to complete the Direct Deposit Authorization. This ensures fast and secure payments directly to their bank accounts.

A completed W-9 and Direct Deposit Authorization are key verification documents.

How Threshold Verifies Ownership

Once a property owner or operator submits their packet, our Landlord Support Team begins the verification process. The goal is to confirm that the individual or entity listed as the payee is the legal owner or authorized manager of the property.

Assessor’s Office Cross-Check

The primary tool we use for ownership verification is the County Assessor’s Office records. Each property has a parcel number, which allows us to look up ownership details in the county’s public records. We check that:

- The owner’s name on the Assessor’s website matches the name provided in the Landlord Packet.

If all information matches, the process moves forward smoothly. However, if there are any discrepancies — such as a name mismatch or outdated ownership records — these issues must be resolved before the property can be approved for payments.

Ownership details are cross-checked with County Assessor’s Office records.

Management Companies & Third-Party Payees

Some owners choose to have a management company handle rent payments on their behalf. In these cases:

- The W-9 form for the management company must be submitted.

- A Property Management Agreement authorizing the company to receive payments on behalf of the owner.

Common Issues That Cause Delays

To avoid interruptions in payments, property owners and operators should double-check all submitted information. The most frequent issues that cause delays include:

- Incomplete or inaccurate Taxpayer ID Forms (missing SSN/EIN, incorrect names, or missing signatures).

- Ownership discrepancies between submitted forms and County Assessor’s records.

- Missing IRS Form W-9 for management companies handling payments.

- Unreported ownership or management changes (new owner, new management company, or expired agreements).

To ensure timely payments, owners and operators should keep their information up to date and respond promptly if the Landlord Support Team requests corrections or additional details.

Property owners should update records when ownership or management changes.

Keeping Current

Ownership verification isn’t just a one-time process — you must update it whenever ownership, management company, or payment details change. Keeping this information current is essential for ensuring timely and uninterrupted payments when a new tenant moves in.

Owners and operators should notify Threshold immediately if:

- The property is sold to a new owner.

- A new property management company takes over.

- A management agreement expires or is updated.

Failure to update this information can result in payments being paid to the wrong entity.

If there’s a change in ownership provide as much contact information of the new owner as possible

Final Steps After Ownership Verification

Once ownership has been successfully verified, the process moves forward with unit verification:

Rent Reasonableness Analysis

Before signing a lease, our Landlord Support Team verifies that the proposed rent aligns with Fair Market Rents and compares it to similar properties in the area.

Learn more about rent reasonableness

Inspection

All properties must pass a Housing Quality Standards (HQS) inspection within 30 days prior to move-in. Owners can use the HQS Tip Sheet included in the Landlord Packet to prepare for common inspection issues.

Keeping ownership records current helps maintain smooth participation in the program.

Summary

Verifying ownership is a crucial step in ensuring that property owners and operators receive secure and timely payments through the Threshold program. By providing complete and accurate information from the start, owners can avoid delays and move quickly through the leasing process.

For any questions about ownership verification, the Threshold Landlord Support Team is available to assist.

How we support property owners

By staying proactive and keeping ownership records current, property owners and operators can ensure seamless participation in the Threshold program — helping provide safe and stable housing to those who need it most.