Imagine a housing market where more than 7 million of the nation’s most vulnerable renters — those earning the least — can’t find an affordable place to call home. This isn’t a hypothetical scenario. It’s the stark reality unveiled by the National Low Income Housing Coalition’s (NLIHC) latest annual report, “The Gap: A Shortage of Affordable Homes.”

Released in March 2025 by the NLIHC, The Gap report shines the spotlight on a crisis that affects property owners and renters alike, especially here in Arizona. At Threshold, we’re tackling this head-on as the state’s first centralized landlord engagement service, launched by HOM, Inc. in 2021. Our mission? To partner with Arizona property owners, offering risk mitigation to provide safe, stable housing for those struggling with homelessness.

“The housing crisis affects real people — like families and individuals just trying to get by,” says Stella Darnall, Threshold’s Landlord Engagement Supervisor. “Property owners can make a big difference by providing stable homes, and we’re here to help make that possible.”

The Gap report reveals critical truths every property owner and operator should know. In this blog, we’ll unpack The Gap report’s key findings — from the scale of the shortage to the renters most impacted — and show how property owners and operators can turn these insights into action with Threshold’s support.

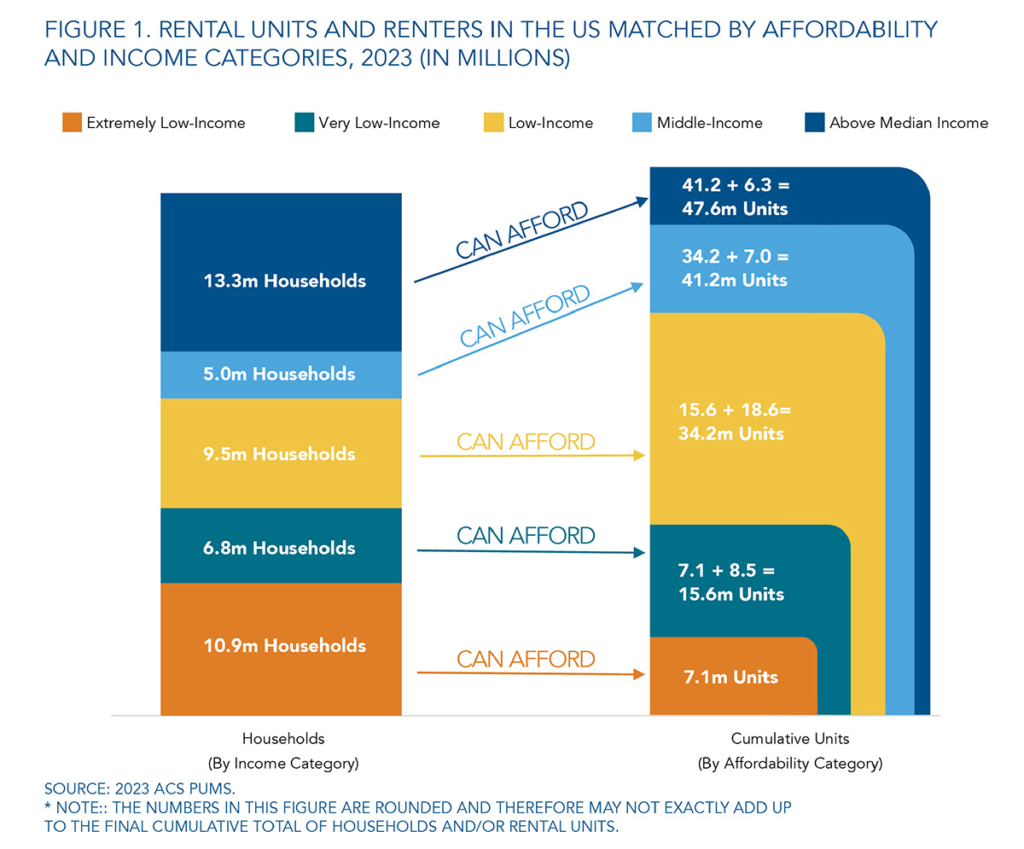

Extremely low-income renters must compete with all higher-income households for the limited number of rental homes affordable to them in the private market.

The Scale of the Affordable Housing Crisis

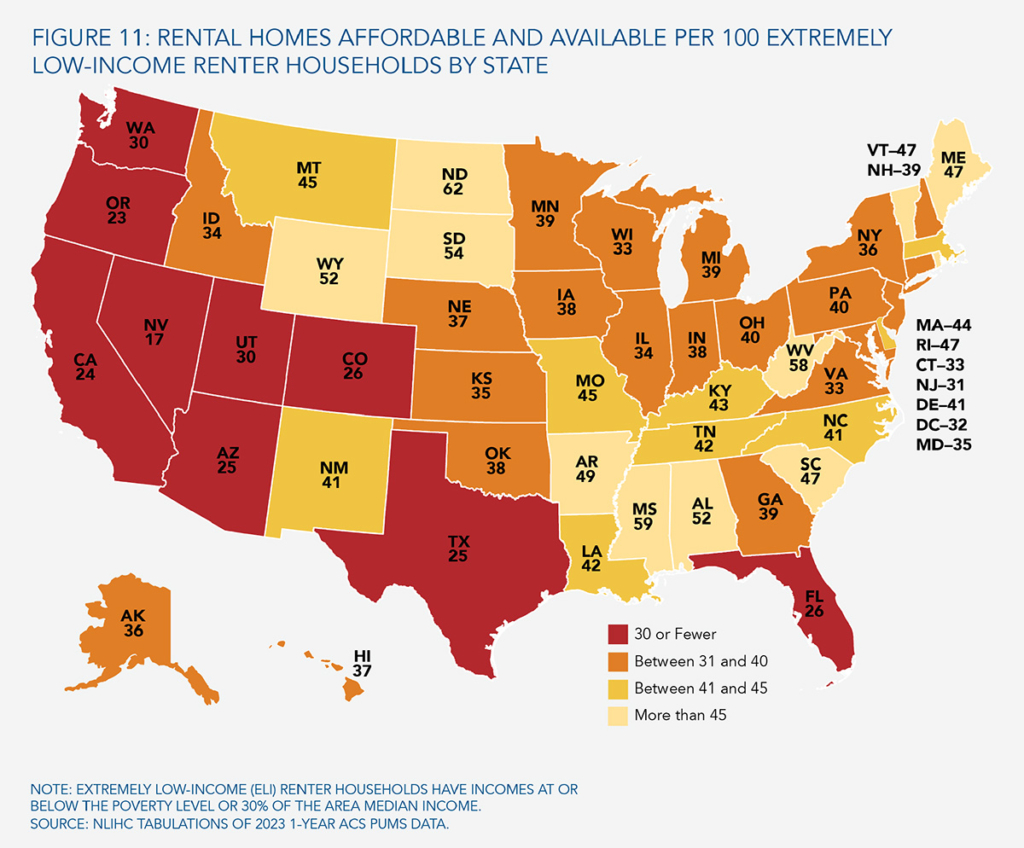

The Gap report lays bare a national emergency: a shortage of 7.1 million affordable and available rental homes for extremely low-income renters. This includes those with incomes at or below 30% of the area median income (AMI) or the federal poverty line. Nationwide, only 35 affordable and available homes exist for every 100 of these households, leaving millions scrambling for shelter.

In Arizona, the situation is even bleaker. With just 25 homes per 100 extremely low-income renters, Arizona ranks among the states with the most severe shortages. This gap isn’t just a statistic — it’s a daily struggle for families, seniors, and workers who can’t find housing they can afford.

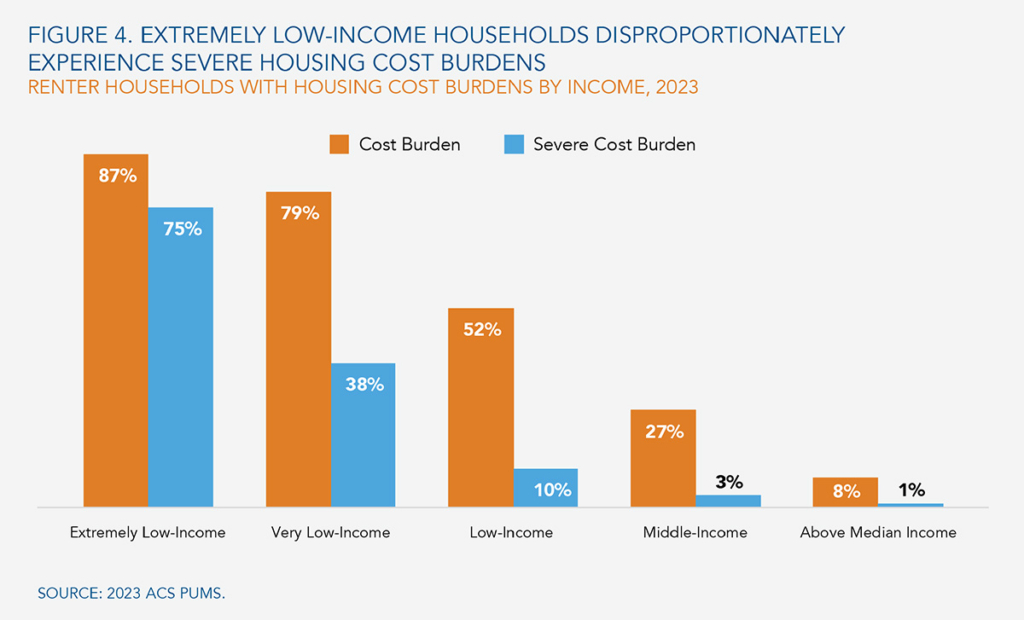

Compounding the crisis, The Gap report finds that 75% of these renters are severely cost-burdened. This means they are spending over half their income on rent. In Arizona, that figure climbs to 81%, meaning most low-income renters here sacrifice essentials like food or healthcare to keep a roof overhead.

For property owners, this shortage drives up demand for affordable units, creating both challenges and opportunities. Landlords face pressure to maintain aging properties profitably while meeting tenant needs. That’s a difficult balance in a market where new construction targets higher earners, with average asking rents for new units hitting $1,802 per month in 2024.

The Gap report underscores that this isn’t a temporary glitch but a systemic failure affecting nearly every U.S. community. For Arizona landlords, this is where Threshold can be a valuable partner. We offer tools to make renting to low-income tenants viable with added risk protection.

Extremely low-income households are not only disproportionately cost-burdened but account for most households with severe cost burdens.

Who Are the Affected Renters?

The Gap report doesn’t just quantify the housing shortage — it reveals who’s bearing the brunt. Extremely low-income renters, the focus of the report, include 10.9 million households nationwide. They’re not a faceless group: 34% are in the labor force, often low-wage workers like retail staff or caregivers; 33% are seniors; 18% have disabilities; and at least 6% are students or single caregivers juggling young children or disabled family members. These are people striving to get by, not high-risk tenants by default.

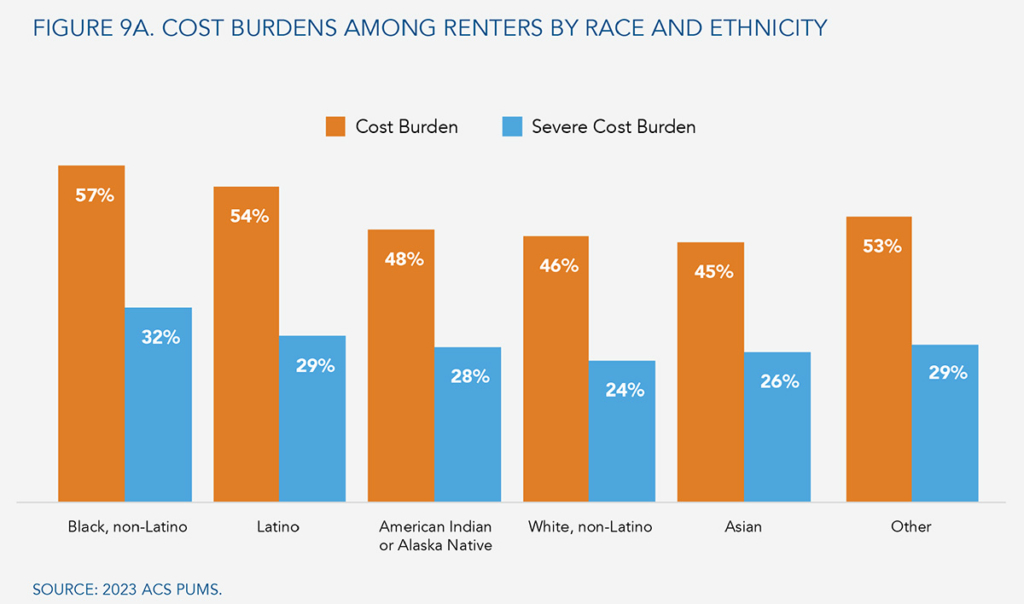

Racial disparities deepen the crisis: 18% of Black, 17% of American Indian or Alaska Native, and 13% of Latino households fall into this income bracket, compared to just 6% of white households.

In Arizona, these demographics hit close to home. Threshold, designed to house those struggling with homelessness, serves many who match this profile — workers, seniors, and families of color disproportionately impacted by the shortage of 25 affordable homes per 100 extremely low-income renters.

The Gap report highlights that these renters aren’t sitting idle: 42% of those in the labor force work full-time, yet their wages — often below the $26.74 hourly needed for a modest one-bedroom — can’t keep up with rent.

Housing cost burdens are especially prevalent among Black and Latino renter households, with more than half being at least moderately cost-burdened compared to 46% of white renter households.

The Threshold Difference

For property owners, this is key intel. These renters represent a steady demand for affordable units, but the private market leaves them underserved. That’s where Threshold shines. We mitigate the risks landlords might fear — late payments, property damage — through our support services, making it safer and smarter to rent to those residents who are desperate for quality housing.

The Gap report shows that extremely low-income renters are a diverse, resilient bunch, not a liability. By partnering with Threshold, Arizona landlords can tap into this market, meeting a critical need in the battle against homelessness while protecting their bottom line.

“Renting to low-income tenants can seem risky, but with the right support, it doesn’t have to be,” says Darnall. “At Threshold, we provide the tools and guidance you need to make it work for both you and your tenants.”

Why the Private Market Falls Short

The Gap report pinpoints a hard truth: the private market can’t deliver affordable housing for extremely low-income renters without help. Why? The math doesn’t add up. A family of four at the poverty line can afford just $780 monthly for rent, while a single person on Social Security Income manages only $283.

Compare that to new multifamily units averaging $1,802 in 2024 — 47% of which exceed $1,850. These rents don’t cover development or operating costs for new builds, so developers target higher earners, leaving the lowest-income renters out in the cold.

Older housing should become more affordable over time, but The Gap shows this isn’t a cure-all. In competitive markets like Arizona’s urban centers, property owners and operators often renovate older units to chase higher rents, reversing the filtering process.

Even when it works, affordable rents rarely cover maintenance costs for aging properties, pushing landlords to either raise prices or let units deteriorate. In weaker markets, some abandon rental properties altogether. The result? A systemic 7.1 million home shortage that the private market can’t fix alone.

For Arizona property owners, this creates a Catch-22: maintain affordable units at a loss or price out the tenants who need them most. The Gap underscores why subsidies are essential, and that’s where Threshold steps in. We provide risk mitigation to make renting to low-income tenants profitable and sustainable.

In a state with just 25 affordable homes per 100 extremely low-income renters, Threshold turns a market failure into an opportunity. The Gap report proves the private sector needs partners like us to bridge the divide.

Communities across the nation are impacted by the affordable housing crisis. Every state lacks a sufficient supply of rental housing that is affordable and available to extremely low-income households.

Final Thoughts

For Arizona property owners, The Gap report isn’t just a wake-up call — it’s a roadmap. At Threshold, we turn these findings into action. We’re equipping landlords with risk mitigation and tenant support to house those facing homelessness — many of whom match the report’s hardest-hit profiles.

This isn’t charity; it’s smart business. By partnering with Threshold, you meet a pressing need while securing your investment in a market stretched thin.

“Working together, we can provide more than just a roof over someone’s head,” says Darnall. “We can offer them security and a chance to succeed. By partnering with Threshold, you’re making a real impact, while also protecting your investment.”

The Gap Report presents a national challenge, but Threshold offers a local solution. Dive into The Gap to grasp its scope, then take a closer look at how Threshold works.

Together, we can shrink Arizona’s gap, one stable home at a time. The crisis is real — and your role in solving it can be, too.