As we move past the first quarter of 2025, the Phoenix and Tucson rental housing markets continue to evolve, presenting both challenges and opportunities for landlords and property owners. This update dives into the latest trends in occupancy, rent prices, concessions, market stabilization, and new development, comparing both Phoenix and Tucson to national averages. Drawing on data from ALN Apartment Data and the Arizona Multihousing Association, our goal is to provide a clear picture of the current rental landscape to help you make informed decisions.

Key Takeaways (Year Over Year):

- The Phoenix rental market continues to lag behind the national rent average and Consumer Price Index.

- South Tucson’s occupancy rate has increased by over 11%, though Greater Tucson saw a reduction of 0.8%

- Properties in Maricopa County are twice as likely to offer concessions as the national average, 42% and 21%, respectively.

Occupancy Trends

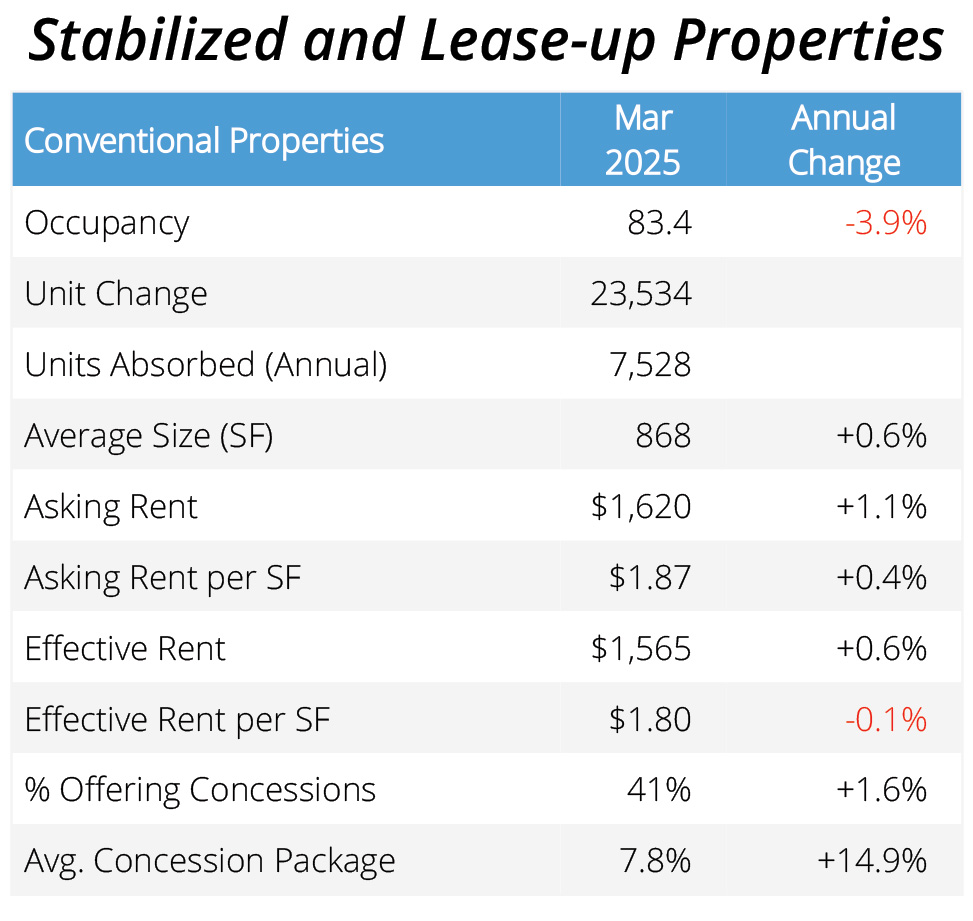

Phoenix occupancy trends for stabilized and lease-up properties for Q1 of 2025.

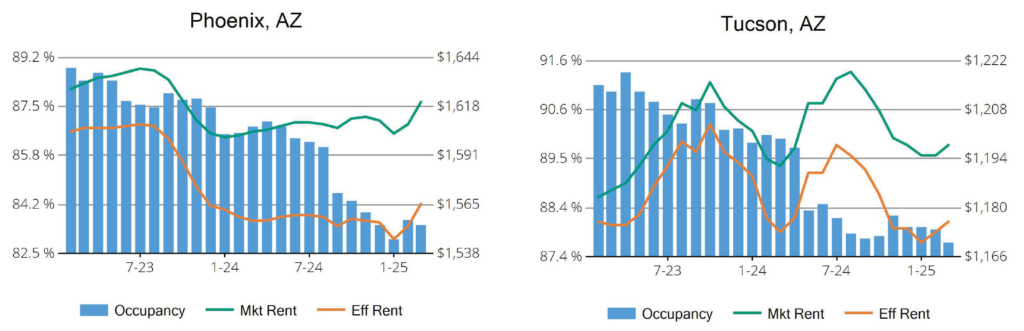

Phoenix has seen a noticeable decline in occupancy rates, with a year-over-year (YOY) drop of 3.9% in Q1 2025 compared to 2024. Tucson also dropped by 2.7% compared to last year. This decrease is partly driven by rising costs, as the average asking rent in Phoenix increased by 1.1%, with rent per square foot up by 0.4%. In Tucson, the average asking rent increased by 0.7% and the asking rent per square foot went up 0.6%.

Nationally, the occupancy rate is also down, but by a more modest 2.2% YOY. These figures suggest that Phoenix and Tucson are facing stronger headwinds than the national average, likely due to increased competition and pricing pressures. For landlords in these two rental markets, this underscores the importance of strategic pricing and tenant retention to maintain occupancy levels.

Rent Price Movements

Rent prices in Phoenix have risen modestly, with the average asking rent for stabilized and lease-up properties reaching $1,620, a 1.1% YOY increase. In Tucson, asking rent is at $1,198, a 0.7% YOY increase. However, this growth lags behind the national average, where asking rents have climbed 3.8% to $1,788.

Notably, both Phoenix and Tucson’s rent increases are below the Consumer Price Index (CPI) of 2.4%, indicating that rent growth is not keeping pace with inflation. This gap could squeeze landlord margins, especially in a rental market with declining occupancy. Nationally, stronger rent growth reflects more robust demand in other regions, but Phoenix’s slower pace may signal a need for landlords to explore alternative strategies to maximize revenue.

Rise in Concessions

Concessions have become a key tool for attracting tenants in a competitive rental market. Concession are “deals” offered to prospective tenants to make it more enticing to rent. Common examples of rental concession are:

- First month’s rent free

- Lowered security deposit

- Lower rent for a specific time period

In Phoenix, 41.4% of conventional properties are offering concessions. That number is 36% percent in Tucson — both significantly higher than the national average of 21.6%.

Occupancy vs. Max Rent vs. Effective Rent for Phoenix and Tucson, Q1 2025

Additionally, 7.2% of Phoenix properties and 6.1% of Tucson properties are offering concession packages, aligning with national trends (9.8%). Examples of these packages include:

- Package 1: One month free rent plus waived application fees.

- Package 2: Reduced security deposit combined with free parking for a year lease.

- Package 3: Two months free rent for an 18-month lease.

Conventional properties dominate the Phoenix and Tucson rental markets, making up 84% and 82% of the total, respectively, compared to 72% nationally. The average apartment size in Phoenix is 868 square feet, slightly smaller than the national average of 903 square feet. In Tucson, apartments are even smaller, coming in at an average of 771 square feet.

The high prevalence of concessions reflects increased competition, pushing landlords to offer incentives to fill units. This trend highlights the need for creative leasing strategies to stay competitive.

Market Stabilization Post-2023

The Phoenix and Tucson rental markets experienced significant upheaval during the COVID-19 pandemic, with dramatic rent increases driven by high demand and limited supply. However, a correction in Q3 and Q4 of 2023 helped bring the market back to a more balanced state. Data from Q1 2025 suggests that this stabilization has continued, with more predictable rent growth and occupancy trends. While challenges like lower occupancy and increased concessions persist, the absence of extreme volatility offers landlords a more stable environment to plan for the future. This stabilization is a positive sign, but it also means landlords must adapt to a rental market that rewards efficiency and tenant-focused strategies.

Phoenix Westward Expansion

Phoenix continues to grow, particularly on its west side, where 22,718 new units are in the pipeline in Goodyear, Avondale, and Buckeye. This significant development outpaces other areas of the metro, including:

- Far north Phoenix: 17,028 units

- Downtown: 9,712 units

- ASU/Tempe area: 9,090 units

- Gilbert: 8,421 units

This westward expansion signals a robust future supply of rental units, which could further intensify competition in the coming years. While this growth reflects Phoenix’s ongoing appeal as a migration hub, it also means landlords in these areas may face increased pressure to differentiate their properties to attract tenants.

Growth in Tucson

The Oro Valley and far north Tucson are the fastest-growing submarkets in southern Arizona, with 3,930 new units currently in the construction pipeline. Central Tucson checks in with 1,505 units, followed by south Tucson (675), northwest Tucson (594) and the Drexel Heights/airport area (327).

Tucson continues to expand with new construction in the pipeline.

Partner with Threshold to Make a Difference

In a competitive Arizona rental housing market, property owners have a unique opportunity to address declining occupancy and contribute to a stronger community by partnering with Threshold.

Threshold connects landlords with tenants in need, particularly those experiencing housing instability, while offering robust support to ensure a successful rental experience. With over 3,313 households housed and 600+ property owners managing 1,350 properties across Maricopa County, Threshold is transforming lives one home at a time.

With Threshold, you gain access to:

- Risk Mitigation Fund: Covers damages beyond normal wear and tear, reducing financial risks.

- Dedicated Support: A Landlord Support Specialist provides personalized, 24/7 assistance to address any concerns.

- Padmission Platform: List and manage vacant properties online to connect with tenants quickly.

- Community Impact: Help end homelessness by providing stable homes, strengthening Arizona’s neighborhoods.

Take Action Today: Contact us to learn how you can partner with Threshold, fill your vacancies, and make a lasting impact on your community. Together, we can build a stronger, more inclusive Phoenix.

All statistics and charts used in this update are sourced from ALN Apartment Data and the Arizona Multihousing Association, April 2025.