Understanding rent reasonableness is crucial for property owners and managers navigating the complex rental housing landscape. At its core, rent reasonableness refers to the evaluation of whether the rent charged for a property is justified given its characteristics, location, and prevailing market conditions. This assessment is not only a practical necessity but also a legal requirement in many areas, particularly where housing voucher programs or subsidized housing initiatives are involved.

For property owners and managers, grasping the concept of rent reasonableness is more than just complying with regulations—it’s about optimizing property performance and maintaining financial sustainability.

“Owners can attract and retain tenants more effectively by ensuring that rents are reasonable and competitive,” says Trevor Thundershield, Landlord Support Supervisor for Threshold. “This, in turn, reduces vacancy rates and enhances overall tenant satisfaction—crucial metrics for long-term profitability in the rental housing market.”

In this blog, we’ll examine the intricacies of rent reasonableness from the perspective of property owners and managers. We explore rent reasonableness, the factors that influence it, and the methodologies used to determine it. Furthermore, we address the challenges faced by property professionals and highlight best practices to manage rent reasonableness evaluations effectively.

What is Rent Reasonableness?

At its essence, rent reasonableness refers to the evaluation and justification of the rent charged for a property in relation to its characteristics, location, and the prevailing market conditions. This evaluation serves multiple purposes, including ensuring fairness in rental pricing, complying with regulatory requirements, and maximizing financial outcomes for property owners and managers.

The primary purpose of conducting rent reasonableness evaluations is to protect the interests of tenants by preventing excessive rents that could strain their financial resources. It also safeguards the interests of property owners by ensuring they receive fair compensation for using their properties.

In many areas, rent reasonableness is not just a matter of financial prudence but a legal obligation. Government agencies, notably those administering housing voucher programs or overseeing subsidized housing initiatives, mandate that rents charged be reasonable and justifiable. These regulations are designed to prevent overcharging of tenants and to ensure that public funds allocated for housing assistance are used effectively and efficiently.

Factors Influencing Rent Reasonableness

Rent reasonableness assessments are influenced by various factors determining a property’s appropriate rent level. These factors can be broadly categorized into location-specific considerations, property-specific attributes, and broader market trends.

Location-Specific Factors

“The location of a property is the most significant determinant of its rent reasonableness,” says Thundershield.

Urban areas typically command higher rents due to proximity to amenities, employment opportunities, and cultural attractions. Conversely, rural areas may have lower rent expectations, influenced by factors such as distance from urban centers and availability of services. Regional variations also play a role, as rental markets can differ significantly between states, cities, and even neighborhoods within the same locality.

Property-Specific Attributes

The property’s characteristics and condition are crucial in determining rent reasonableness. Factors such as the property size, number of bedrooms and bathrooms, layout, and amenities (e.g., parking, laundry facilities, outdoor spaces) all impact the perceived value and, thus, the rental price.

“Properties that are well-maintained and offer desirable features command higher rents than those needing repair or lacking modern conveniences,” says Thundershield.

Current Market Conditions

Market dynamics and rental comparables provide essential benchmarks for assessing rent reasonableness. Property owners and managers often look to comparable properties in the same neighborhood or similar areas to gauge prevailing rental rates. This comparative analysis considers property type, size, condition, and amenities to determine a competitive yet reasonable rent.

Monitoring market trends, such as supply and demand fluctuations and economic conditions, helps in adjusting rental prices to remain competitive and attractive to prospective tenants.

How to Determine Rent Reasonableness

Determining rent reasonableness involves a structured process aimed at assessing whether the rent charged for a property is justified and competitive within its market context. This process typically includes several key steps designed to gather data, analyze comparables, and document findings.

Gather Rental Data

The first step is to collect comprehensive data about the property being evaluated. This includes details such as its location, size, amenities, and current rental rate. Property owners may also gather data on similar properties in the vicinity to establish a baseline for comparison.

Evaluate Comparables

Once data is collected, property owners and managers analyze rental comparables—properties that are similar in size, type, and location—to determine what comparable properties are renting for. This comparative analysis helps us to understand the range of reasonable rental rates in the market.

Adjust for Differences, If Applicable

Not all properties are identical, and adjustments may need to be made for differences such as amenities, overall condition, or unique features.

“Adjustments ensure that the rental comparison is as accurate and relevant as possible to the specific property being evaluated,” says Thundershield.

Benefits of Ensuring Rent Reasonableness

Ensuring rent reasonableness offers numerous benefits for property owners and managers. These benefits extend beyond regulatory compliance to encompass financial stability, tenant satisfaction, and operational efficiency.

Compliance with Housing Programs

One of the primary benefits is compliance with housing voucher programs and subsidized housing initiatives. These programs often require property owners to demonstrate that their rents are reasonable and within prescribed limits.

“By conducting thorough rent reasonableness assessments, owners can maintain eligibility for these programs, ensuring steady rental income and minimizing administrative burdens associated with compliance,” says Thundershield.

Attracting and Retaining Tenants

Prospective renters are increasingly savvy and comparison shop for the best value.

Setting reasonable rents is vital to attracting and retaining tenants.

Properties with competitive rental rates are more likely to attract a larger pool of qualified tenants, reducing vacancy rates and turnover costs, according to Thundershield.

Additionally, fair rental pricing enhances tenant satisfaction, fostering long-term occupancy and positive relationships between tenants and property management.

Financial Viability and Profitability

By setting rents that align with market conditions and property features, owners can optimize revenue streams while effectively managing expenses. This financial stability allows for reinvestment in property maintenance and improvements, enhancing overall property value and tenant experience.

Long-Term Sustainability

Maintaining rent reasonableness promotes the long-term sustainability of rental properties. Stable rental income and prudent fiscal management mitigate risks associated with economic fluctuations or unexpected expenses. Property owners can better weather market downturns and position their properties competitively in dynamic rental markets, ensuring continued viability and resilience over time.

Challenges Faced by Property Owners and Managers

Navigating rent reasonableness can present several challenges for property owners and managers, impacting their ability to effectively set and maintain rental rates that are both fair and competitive.

Fluctuating Market Conditions

One of the primary challenges is dealing with fluctuating market conditions. Rental markets can be volatile, influenced by economic trends, changes in employment rates, and shifts in housing demand. Property owners must stay abreast of these fluctuations to adjust rental rates accordingly. Failure to do so can result in vacancies or undercharging, both of which can affect the financial health of the property.

Legal and Compliance Issues

Rent reasonableness is not just a matter of market dynamics; it also has legal implications. Property owners and managers must ensure that the rents they charge comply with local, state, and federal regulations. This includes adhering to guidelines set by housing voucher programs or other subsidized housing initiatives. Both often require rigorous documentation and justification of rental rates.

Non-compliance can lead to penalties, loss of subsidies, or legal disputes, underscoring the importance of thorough and accurate rent reasonableness assessments.

Balancing Tenant Needs and Financial Viability

Another challenge is balancing meeting tenant expectations and maintaining the property’s financial viability.

“While tenants may seek lower rents, property owners must ensure that rental rates are sufficient to cover operating expenses and maintenance costs and provide a reasonable return on investment,” says Thundershield.

This balancing act requires careful consideration of both market forces and property-specific factors to arrive at rents that are sustainable for both parties involved.

Best Practices for Property Owners/Managers

Effective rent reasonableness management requires adopting best practices that align with market dynamics, regulatory requirements, and the property’s unique characteristics.

Property owners and managers should conduct regular rent reviews. Doing so will keep them informed about market trends and ensure that rental rates remain competitive and reasonable. This involves monitoring rental comparables, analyzing local market conditions, and adjusting rents to reflect demand, supply, and economic changes.

“By proactively reviewing rents, stakeholders can maximize rental income while maintaining tenant satisfaction and compliance with regulatory standards,” says Thundershield.

Technology and Data Analytics

Advancements in technology and data analytics have transformed rent reasonableness assessments. Property management software and online rental platforms provide access to real-time market data, rental trends, and comparative analysis tools.

“By leveraging these technologies, owners can streamline the rent evaluation process, improve accuracy in pricing decisions, and gain insights into tenant preferences and market dynamics that influence rental rates,” says Thundershield.

Document Your Assessments

Thorough documentation of rent reasonableness assessments is essential for compliance and transparency. Property owners should maintain detailed records of rental data, comparative analyses, adjustments made, and rationale for rental decisions. This documentation demonstrates adherence to regulatory requirements and serves as a valuable resource during audits, inspections, or tenant inquiries.

Seek Guidance When Needed

Navigating complex rent reasonableness regulations and market dynamics may require professional expertise. Property owners and managers can benefit from consulting with real estate professionals, appraisers, or legal advisors specializing in rental housing and regulatory compliance. These experts can provide valuable insights. They can conduct robust rent analyses and offer guidance on optimizing rental strategies to achieve financial goals while mitigating risks.

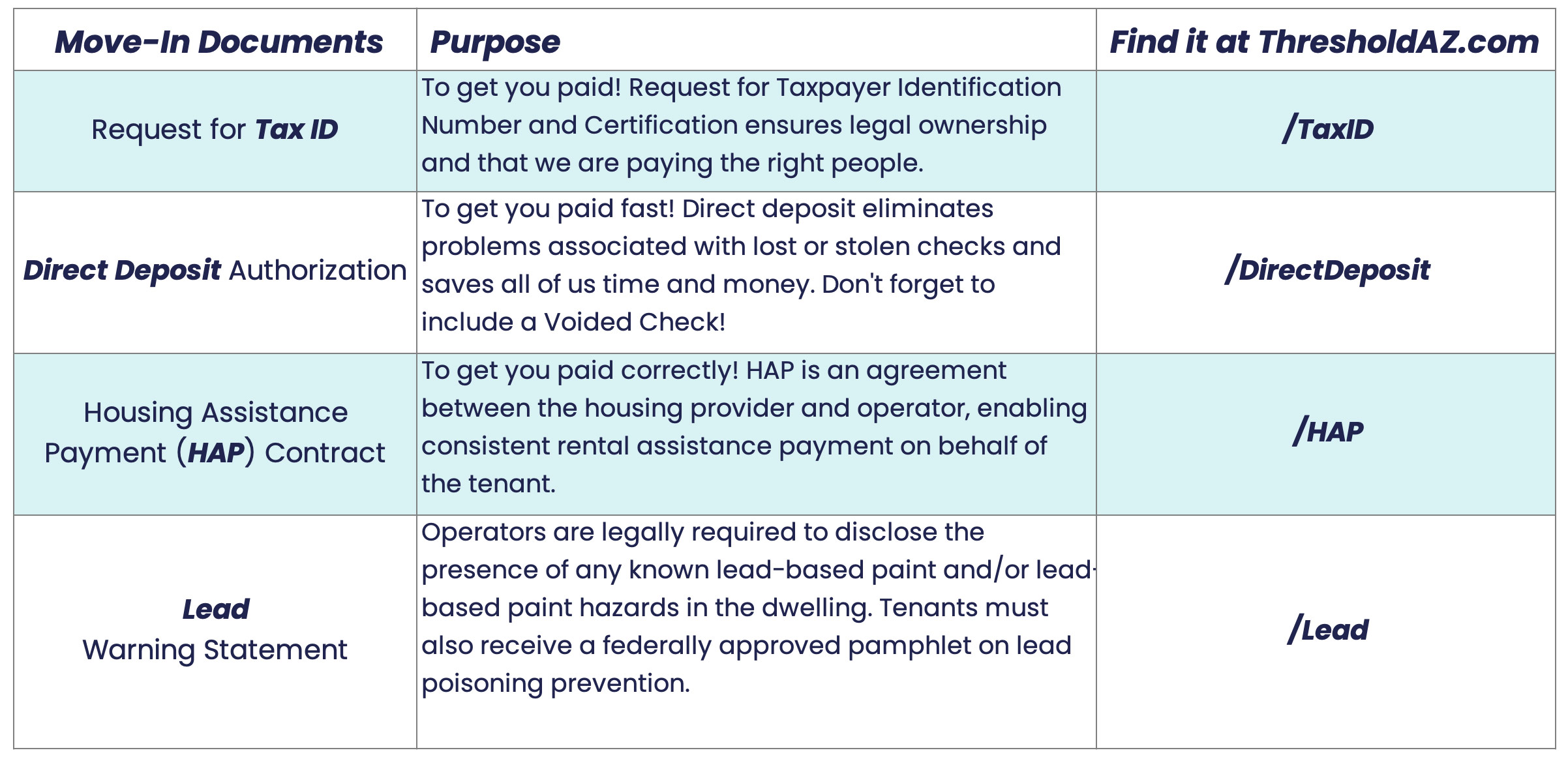

Working with Threshold

At Threshold, we use our housing market expertise to make sure owners and operators maximize their property’s potential. Our expert team provides comprehensive guidance to ensure your rents align with fair market value, meeting both your financial goals and tenant needs. By partnering with us, you’ll navigate the complexities of rent reasonableness with confidence, enhance your property’s performance, and foster positive relationships with your tenants. Contact us today to optimize your rental strategy and achieve a win-win solution for both you and your tenants.