The housing market is a cornerstone of the American economy, influencing everything from personal financial stability to broader economic trends. The 2024 State of the Nation’s Housing report by the Harvard Joint Center for Housing Studies (JCHS), released on June 20, 2024, sheds light on the current state of this vital sector, revealing pressing challenges and significant shifts affecting both homeowners and renters across the country. As property owners and managers navigate these turbulent times, understanding the implications of this report is crucial for making informed decisions that benefit both their businesses and the communities they serve. Here’s what property owners and managers need to know about the recent report:

Housing Costs Continue to Rise

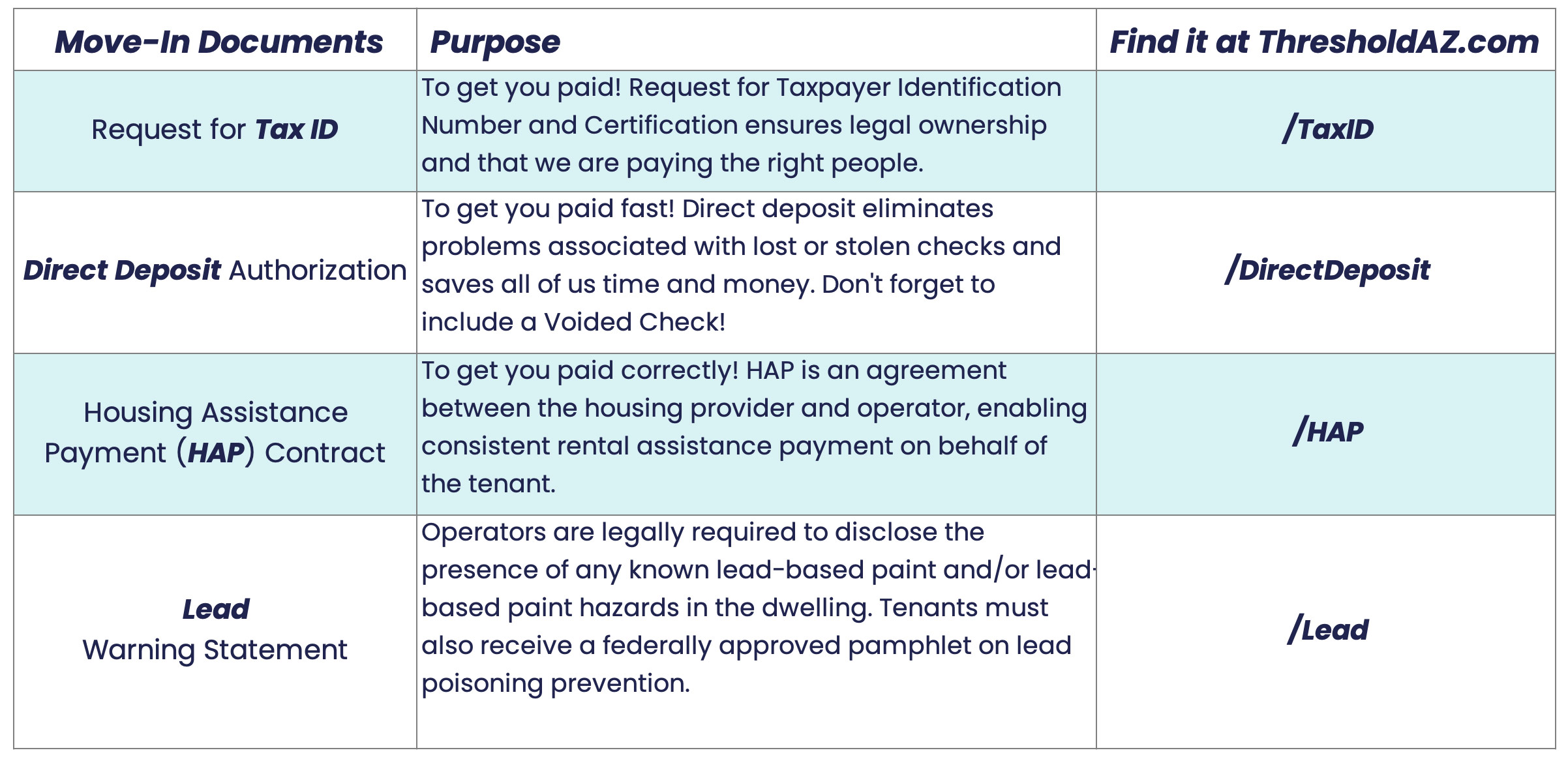

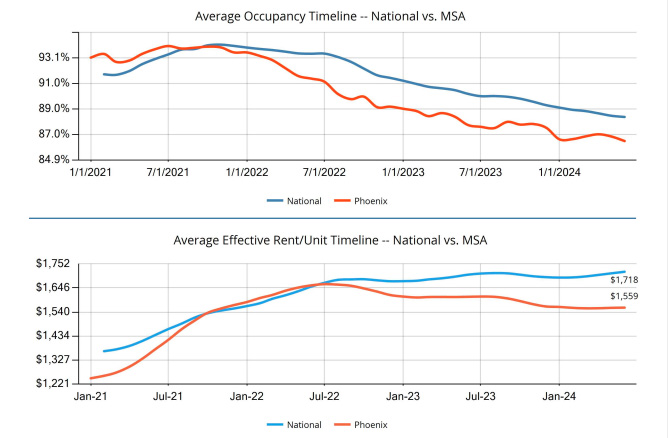

Phoenix, the nation’s 6th largest city, has seen a decrease in effective rent year over year.

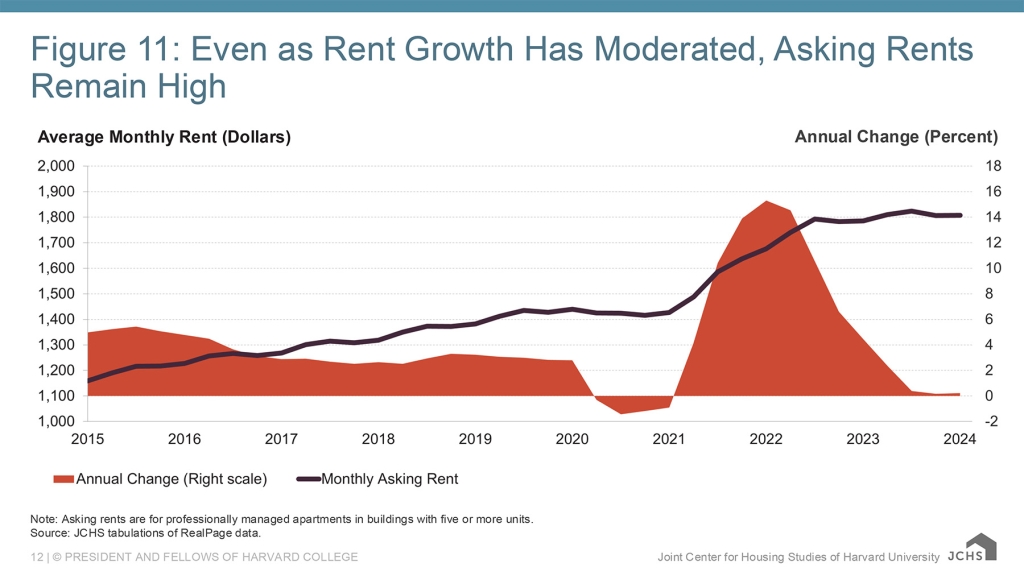

The JCHS report highlights a significant rise in housing costs, impacting both homeowners and renters. Home prices reached an all-time high in early 2024, increasing at an annual rate of 6.4 percent in February. This surge has pushed the U.S. home price index up by 47 percent since early 2020, making the median sales price about five times the median household income. Although rent growth has slowed to 0.2 percent year over year, rents are still up by 26 percent nationwide since early 2020, with three out of five markets experiencing rising rents.

For property owners and managers, these rising costs translate to heightened financial pressures. The significant increase in home prices may deter potential buyers, leading to prolonged vacancies and challenges in maintaining rental rates. Renters, struggling with higher costs, may face difficulties in making timely rent payments, further straining property owners’ finances. Additionally, the increased costs of property maintenance and operations, exacerbated by inflation and rising insurance premiums, add to the financial burden.

Home Ownership is Out of Reach

High housing costs and elevated interest rates have made home ownership increasingly unattainable for many Americans. Despite a brief dip in early 2024, interest rates on 30-year mortgages rose to over 7 percent by mid-April, resulting in the highest mortgage costs in 30 years for a median-priced home. Consequently, first-time home buying has decreased, with the US homeownership rate inching up by only 0.1 percent in 2023 to 65.9 percent, the smallest increase since 2016. This trend has particularly affected racial minorities, with Hispanic and Black homeownership rates significantly lower than that of white households.

The decreased accessibility of homeownership presents both challenges and opportunities for property managers. On the one hand, the reduced demand for home purchases can lead to a higher demand for rental properties, potentially increasing occupancy rates. On the other hand, this shift necessitates a focus on equitable and inclusive rental practices to attract and retain a diverse tenant base. Ensuring that rental properties are accessible and affordable for all, especially those disadvantaged by the current housing market, becomes crucial.

Cost Burdens Hit Record Highs

The recent report also indicates that the number of cost-burdened renters and homeowners has reached unprecedented levels. As of 2022, half of all renter households spent more than 30 percent of their income on housing and utilities, the highest number on record. Similarly, the number of cost-burdened homeowners increased by 3 million to 19.7 million between 2019 and 2022, with a sizable portion of this burden falling on households with incomes under $30,000. Rising insurance premiums and property taxes further exacerbate these financial pressures.

The rise in cost burdens poses a significant risk for property owners. With renters and homeowners increasingly stretched thin, the likelihood of rent defaults and vacancies increases, potentially disrupting cash flow and overall income. Additionally, the financial strain on tenants can lead to deferred property maintenance and repairs, further escalating operational costs for property owners.

Even though the boom has passed, asking rents still remain high year over year. (Graph courtesy Joint Center for Housing Studies of Harvard University.)

Multifamily Units Soften Rental Market

In response to rising housing demand, multifamily housing surged by 22 percent in 2023, reaching the highest annual level in over three decades. This influx of new rental units has begun to cool the rental market, as the increase in supply has outpaced the growth of new renters. Consequently, vacancies have risen and rent growth has slowed. However, this increased supply has not come without challenges, as property owners face rising operating costs, including a 27.7 percent increase in owners’ insurance premiums and a 7.1 percent rise in overall apartment operating expenses over the past year.

For property managers, the cooling rental market presents a mixed bag of opportunities and challenges. The increased supply of rental units can provide tenants with more options, potentially easing the demand-driven pressure on rents. However, higher vacancy rates and operating costs can strain property managers’ balance sheets. This environment necessitates a strategic approach to maintaining occupancy, particularly as net operating income growth has slowed significantly, dropping from 8.1 percent in early 2023 to 2.8 percent in the first quarter of 2024.

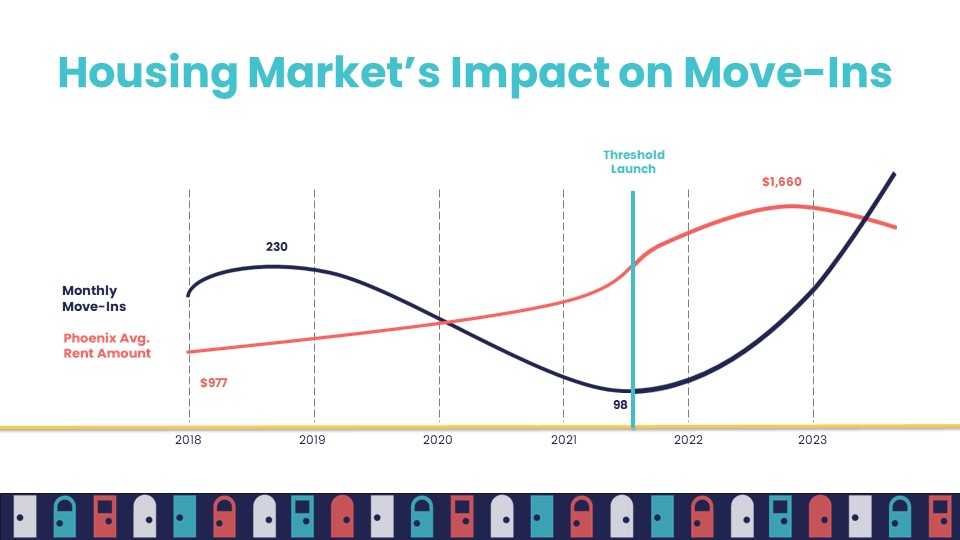

Since its launch in mid-2021, Threshold has been able to change the housing narrative by outpacing the number of programs moving people into homes relative to the Maricopa County housing market.

Homelessness and Climate Change Concerns

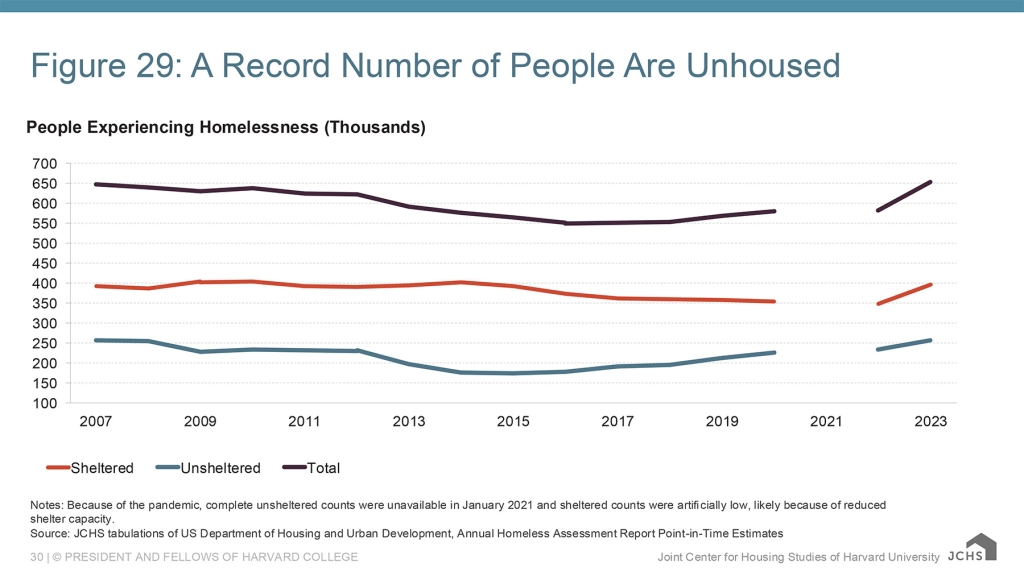

The 2024 report underscores the dual challenges of rising homelessness and climate change threats to the housing stock. In 2023, the number of people experiencing homelessness reached a record high of 653,100, partly driven by the end of pandemic protections and the inflated cost of rent. Additionally, the increasing frequency of billion-dollar climate-related disasters poses a significant risk to housing infrastructure. With 60.5 million housing units located in areas of moderate to high risk from natural disasters, the need for resilient and sustainable housing solutions has never been more urgent.

Meanwhile, the threat of climate-related disasters necessitates investments in resilient infrastructure and sustainable practices to safeguard properties and ensure long-term viability.

Rising homelessness underscores the importance of contributing to social housing initiatives and addressing the broader housing crisis. (Graph courtesy Joint Center for Housing Studies of Harvard University.)

Our Local Landscape: How Arizona’s Housing Market Compares

The Arizona housing market has been cooling quicker than almost any other market in the nation, according to Daniel Davis, Director of Landlord Relations for Threshold. This is due, in part, to Maricopa County having some of the highest rent increases in the nation from 2020-22.

Phoenix has outpaced the national average, shortening the occupancy timeline while keeping rents affordable. (Graphs courtesy ALN Apartment Data Quarterly MSA Report, Q2 2024)

In Arizona, rent skyrocketed on the heels of the Covid pandemic, but prices are beginning to stabilize. The result has been a decrease in both rents and occupancy rates, creating uncertainty and forcing property owners and operators to adapt to a new economic landscape.

“The housing market is dependent on an incredible number of factors,” says Daniel Davis, Director of Landlord Relations for. “While there are many indicators to quantify current status of the market, average rental amount is a common metric to practically measure how tight the market is and who it favors.”

Historically, the rental market has not only correlated with the number of people experiencing homelessness, but also the homeless response system’s ability to adequately support people moving off the streets and out of shelter into permanent housing, says Davis. Threshold was launched in 2022 through funding from Maricopa County to bring together local service organizations and property owners to provide people transitioning out of homelessness safe and stable places to live. In its first year, Threshold has helped 1,250 formerly unhoused individuals and families find safe and stable homes.

Davis says Threshold helps owners and operators keep properties viable during a market downturn.

“By creating a centralized landlord liaison service and suite of products to entice landlord participation, Maricopa County has been able to change that narrative by outpacing the amount of programs moving people into homes relative to the housing market,” says Davis.

Challenges Ahead

The 2024 State of the Nation’s Housing report emphasizes the critical need for a concerted effort among policymakers, nonprofits, and the private sector to address the multifaceted challenges facing the housing market. From the affordability crisis and rising homelessness to the growing threat of climate change, these issues require a collaborative approach to develop sustainable and effective solutions.

By working closely with policymakers and nonprofits, property owners and managers can help shape policies and initiatives that promote affordable housing and community development. Their on-the-ground experience provides valuable insights into the practical challenges and opportunities within the housing market, making their participation crucial in the policy-making process. Moreover, property owners and managers can lead by example, implementing innovative practices and contributing to the development of sustainable housing solutions.

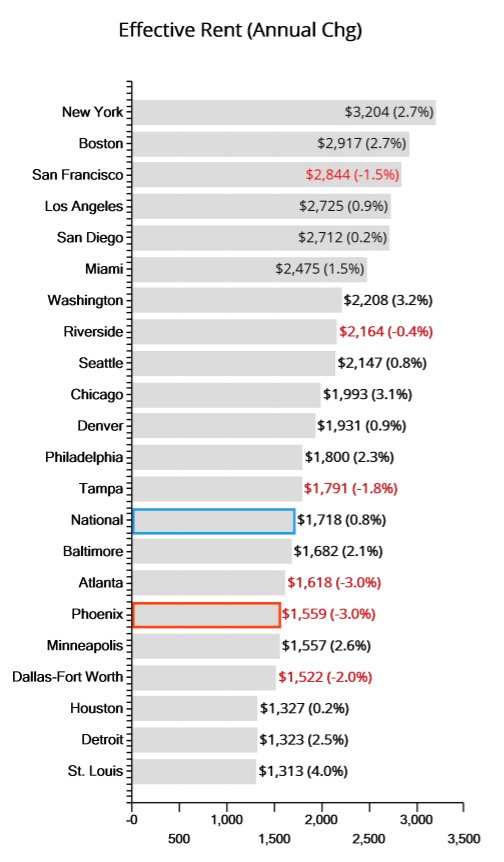

How Threshold Helps Property Owners and Managers

At Threshold, our mission is to provide property owners and managers with the resources they need to operate successful and well-maintained properties while ensuring housing for those in need. By centralizing a full slate of risk mitigation and offering hands-on support, we aim to enhance existing housing voucher programs, making them stronger and more effective.

“The cash flow at [our newest] property is twice what we had estimated in our underwriting because of [Threshold] and we’re able to help a lot of people,” says Jessica Raymond, VP of Operations for Atlantic Development. “You’re only going to lose money if you don’t participate in this program. You’re leaving money on the table if you’re not working with Threshold.”

In light of the findings from this year’s report, it is more important than ever for property owners and managers to leverage these resources to maintain stability and growth. Contact us today to learn more!