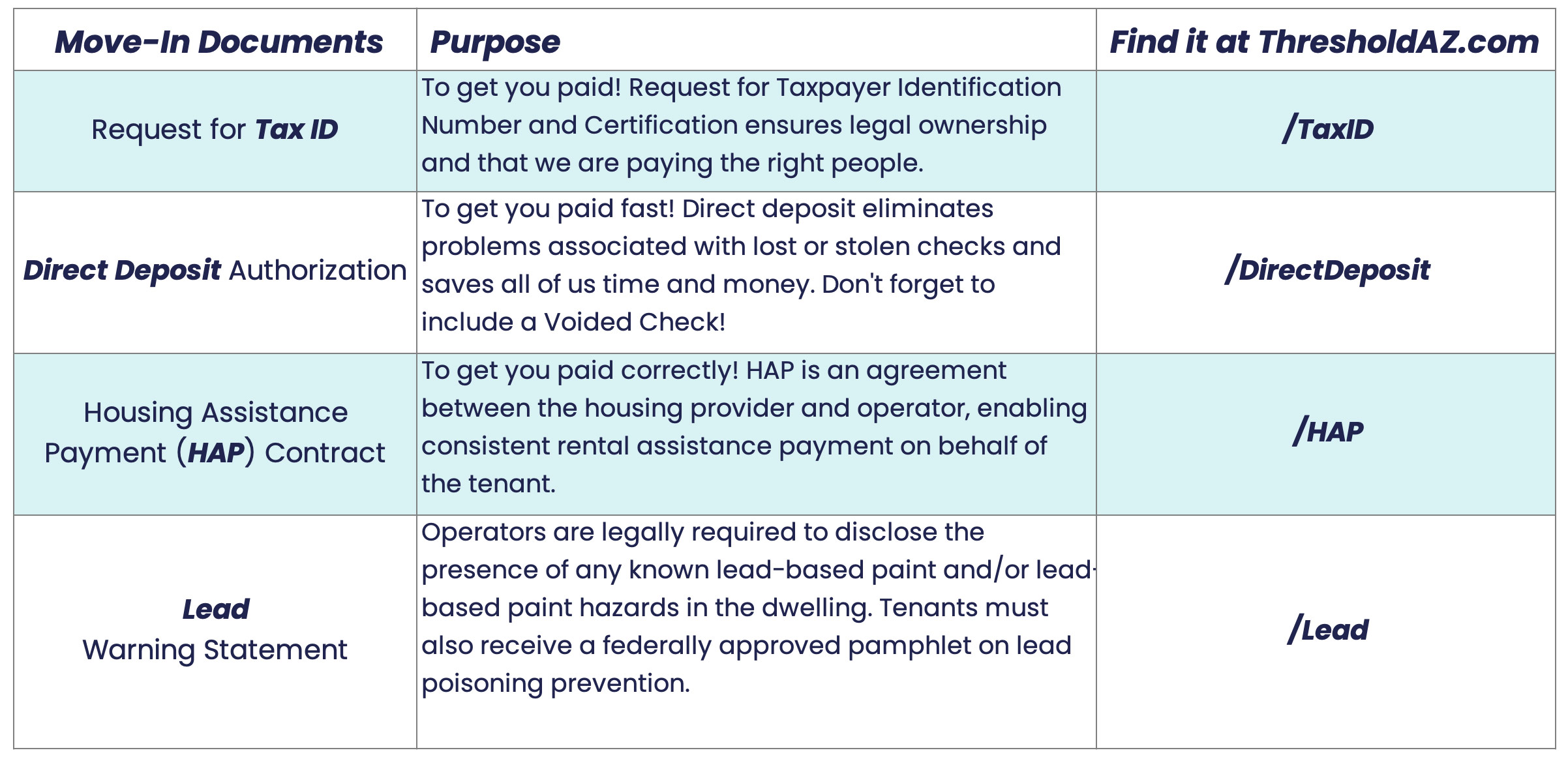

As part of our partnership with property owners and management companies, HOM annually prepares and issues IRS Form 1099s to ensure all rental income is reported accurately and in compliance with federal tax requirements. To make sure your tax forms are processed correctly and without delay, we ask all property partners to keep their W-9 and contact information up to date at all times. Accurate documentation helps ensure that IRS Form 1099s are sent to the correct entity, and that reporting goes smoothly each year.

In this blog, we'll explain the importance of IRS Form 1099 and responsibilities as property owners or operators participating with HOM.

What Property Owners Need to Do

If you are a property owner organized as an individual, sole proprietor, LLC, or partnership, HOM issues an IRS Form 1099 based on the W-9 information we have on file.

Annually, it's important to take a few moments to confirm that your W-9 and contact details are current. Having accurate information on file prevents delays or errors during the yearly tax reporting process.

✅ Note: Corporations typically do not receive a 1099, but it's still important to review your W-9 to confirm your filing status and ensure everything is correct.

A properly completed Form 1099 ensures accurate income reporting to the IRS.

What Property Management Companies Need to Do

Property management companies may also receive IRS Form 1099 from HOM, depending on how rent payments are handled.

- If your company collects rent payments and issues 1099s to property owners, we will need to have your W-9 information on file, and you will receive a 1099 from HOM.

- If your company does not collect rent payments, please ensure we have the property owner's current W-9 on file.

Keeping your information up to date helps prevent any delays or errors in processing.

Submit updates to: landlordengagement@hominc.com

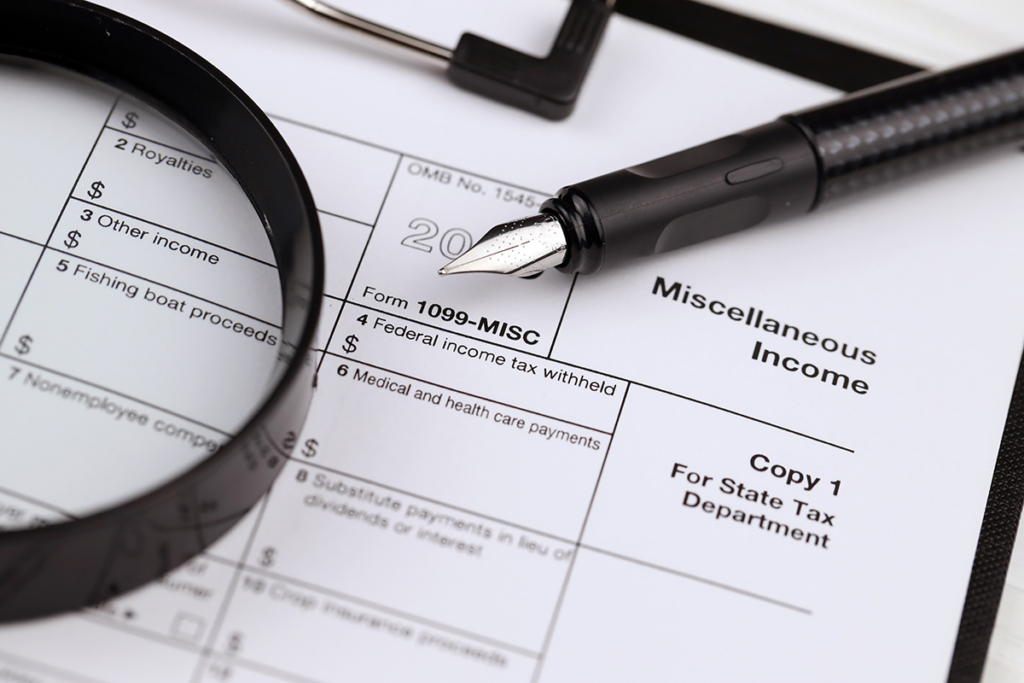

IRS Form 1099 Explained

The IRS Form 1099 is used to report certain types of income other than wages, including rental income paid to property owners and management companies. HOM uses this form to report payments made through its housing programs to help maintain transparency and compliance with federal tax laws.

Why Form 1099 Matters

- Ensures accurate income reporting to the IRS

- Helps avoid discrepancies or audits

- Maintains clarity and compliance between property partners and HOM.

Keeping your W-9 information current ensures you receive your 1099 promptly and without issue each year.

If you're a property owner operating as an individual, sole proprietor, LLC, or partnership, HOM issues a Form 1099 using the W-9 information on file.

Common Questions About 1099s

Here are a few common questions about IRS Form 1099:

Q: Do all property owners receive a 1099?

A: Typically, property owners who are individuals, sole proprietors, LLCs, or partnerships receive a 1099. (Corporations may not, but all participants should verify their W-9 status.)

Q: What if my address or tax ID changes?

A: If your business or tax information changes, please complete a new W-9 and send it to landlordengagement@hominc.com right away.

Q: What happens if I don't update my W-9?

A: Missing or outdated information can delay the delivery of your 1099 or cause payment delays. Updating your W-9 promptly helps avoid these issues.

Our Landlord Support Team is ready to assist with your 1099s and W-9s, whether you have questions, need updates, or want to verify your information.

How We Support Property Owners and Operators

At HOM, our mission is to expand housing opportunities for individuals and families transitioning from homelessness. Strong, reliable partnerships with property owners and managers make that mission possible.

We know that staying on top of forms and requirements can take time — that's why our Landlord Support Team is here to help. Whether you have questions about your 1099, need to update a W-9, or want to confirm the information we have on file, we're happy to assist.

Contact: landlordengagement@hominc.com

Thank You for Your Partnership

Your participation helps provide stable housing to people across Arizona and strengthens our shared commitment to community well-being. We appreciate your partnership and your attention to keeping your information accurate and up to date.

Together, we're making a difference — one home at a time.