As a property owner or operator, receiving timely and reliable payments is crucial to managing your rental business. If you’re part of the Threshold network, you’ll experience not only the opportunity to make a meaningful impact by providing housing to individuals experiencing homelessness but also a streamlined process for receiving payments from HOM, Inc.

Threshold makes it simple for property owners to receive Housing Assistance Payments (HAP) and other fees associated with housing tenants who hold HOM, Inc. housing vouchers. The most efficient way to ensure timely payments is through ACH direct deposit, which eliminates delays, reduces risks, and provides immediate access to funds.

This guide will walk you through the process of receiving payments from HOM, Inc., including how to set up direct deposit, the benefits it offers, and key steps for getting started. Whether you’re new to Threshold or looking to optimize your payment process, this blog will provide all the information you need to make receiving payments easier than ever.

Receiving Payments Through Threshold

When you join the Threshold network, you’re partnering with a program designed to support property owners and operators while addressing housing instability. Payments from Threshold are structured to ensure property owners are compensated promptly and securely for their participation in the program.

Getting paid by Threshold is now easier than ever.

What Payments Can Property Owners Expect?

Threshold property owners receive Housing Assistance Payments (HAP) directly from HOM, Inc. These payments cover a portion of the tenant’s rent, which is determined by the program guidelines. HOM, Inc. administers rental assistance programs on behalf of our provider partners. Threshold offers risk mitigation options that create an additional layer of financial security for property owners and operators.

Additional payments may include:

- Application Fees: HOM, Inc. often covers application fees for participants.

- Security Deposits: Refundable deposits or non-refundable move-in fees are paid to property owners in most cases.

- Damage Claims: If a tenant causes damage beyond normal wear and tear, property owners and operators can file a claim through HOM, Inc. by completing the Damage Claim/Vacancy Loss Worksheet.

- Vacancy Loss Coverage: In cases where a unit is left vacant after a HOM participant moves out, Threshold may provide compensation for lost rental income.

- Risk Mitigation: Threshold funding provides risk mitigation options for property owners and operators.

- Rental Assistance: HOM, Inc. administers rental assistance programs on behalf of our provider partners.

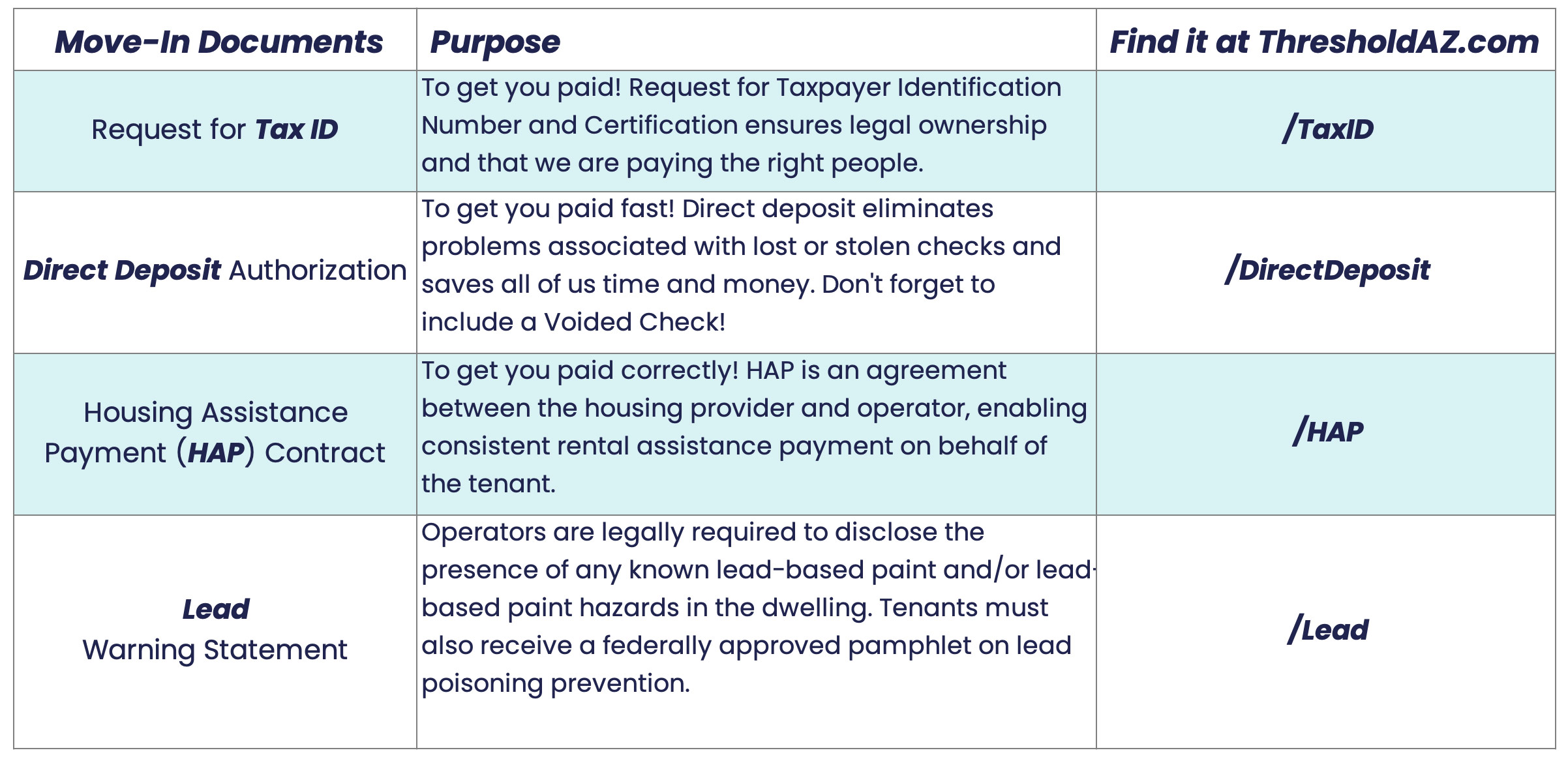

Key Agreements and Requirements

To receive payments, property owners and operators must complete specific agreements and paperwork during the lease-up process. This includes:

- The HAP Contract, which outlines the payment terms between HOM, Inc. and the property owner or operator.

- A standard lease agreement with the HOM participant, including a HOM Tenancy Addendum.

- The Direct Deposit Authorization Form, allowing HOM to process payments via ACH.

- A completed W-9 tax form.

Completing these forms ensures all parties are aligned and that payments can begin as soon as the lease and HAP Contract are finalized.

For additional information or to download forms for specific programs, visit the Forms Central page. For additional questions, please contact your Landlord Support Specialist. If you do not remember your Landlord Support Specialist or don’t have one, please contact HOM, Inc.

Why Choose Direct Deposit?

Setting up ACH direct deposit for receiving payments is the simplest, fastest, and most secure way to manage your funds as a Threshold property owner. Unlike traditional check payments, direct deposit ensures your payments are processed seamlessly, with funds available immediately.

With direct deposit, payments are seamless and funds are available immediately—no more waiting for checks.

Eliminate Payment Delays

ACH direct deposit eliminates the risks of late or lost payments due to postal delays. Payments are processed electronically, ensuring they arrive in your bank account on the 1st of each month, without fail.

Convenience and Security

With direct deposit, there’s no need to visit the bank or handle physical checks. Payments are transferred securely through the Automated Clearing House (ACH) system, minimizing the risk of theft or forgery.

Immediate Access to Funds

Funds deposited via direct deposit are available for use as soon as they hit your account. This ensures you can manage your property expenses without waiting for checks to clear.

Detailed Payment Documentation

HOM, Inc. provides a Housing Assistance Payment (HAP) Itemization Report with each deposit, sent to you via email or mail. This report includes:

- Date and amount of payment.

- Tenant names and payment breakdowns.

- Total payment amount.

- This transparency makes it easy to track payments and reconcile your accounts.

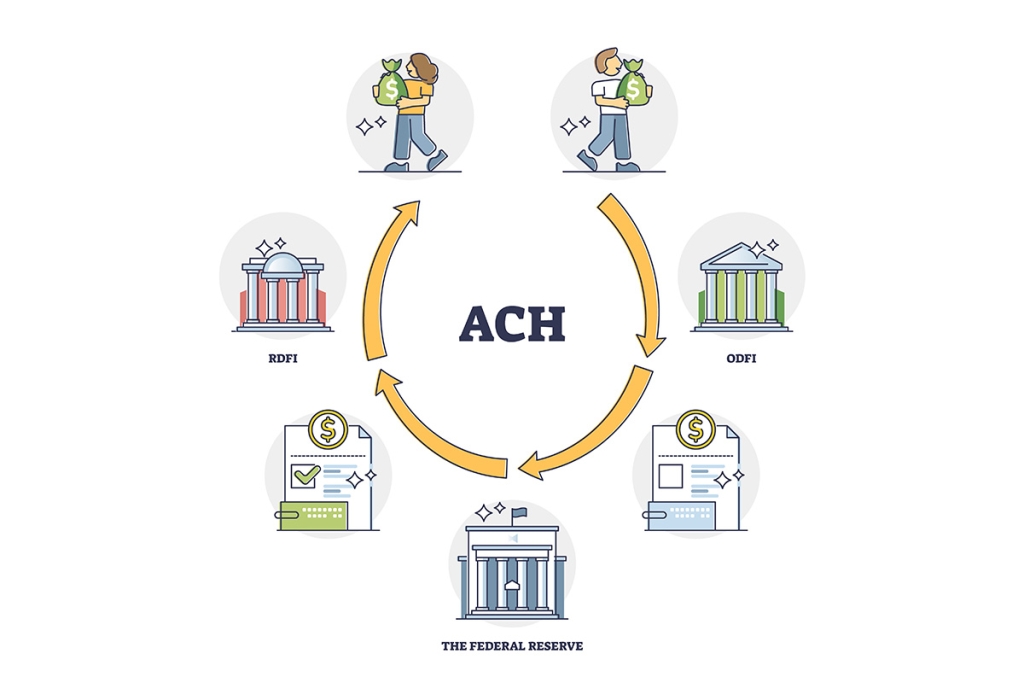

The ACH payment process begins when the sender, such as an employer or a recipient, approves the transaction. The Originating Depository Financial Institution (ODFI) collects the sender’s details, including account and routing numbers. After verification by the ACH operator, the transfer is sent to the Receiving Depository Financial Institution (RDFI), which processes the payment by either crediting or debiting the recipient’s account. Finally, the funds are deposited directly into the recipient’s bank account.

Email Notifications About ACH Payments

Notifications about ACH payments are sent via email from hello@mail.padmission.com. To ensure you receive these notifications promptly, please whitelist this email address in your email settings and check your spam or junk folder if you are not receiving notifications. This will help you stay updated on payment deposits and other important communications.

How to Sign Up for Direct Deposit

Setting up direct deposit for receiving payments from Threshold is a straightforward process. Here’s how you can enroll and start enjoying the benefits:

Step 1: Access the Direct Deposit Authorization Form

- Download the form directly from HOM, Inc.’s website.

- This simple, one-page document gathers the essential information needed to initiate ACH payments.

Step 2: Complete the Form

Fill out the form with the following details:

- Your name and contact information.

- Your bank name, routing number, and account number (checking or savings).

- Your Taxpayer Identification Number (TIN) or Social Security Number.

Double-check your information for accuracy to avoid processing delays.

Step 3: Submit the Form

Send the completed form to HOM, Inc. via fax, email or regular mail. The address and fax number are included on the form.

Step 4: Confirmation and Activation

- HOM, Inc. will process your request and send you a confirmation email with the effective date for your first direct deposit payment.

- Payments will begin depositing directly into your account on the confirmed date.

Updating Your Bank Information

If your bank account details change, simply complete and resubmit a revised Direct Deposit Authorization Form. HOM will update your information and provide confirmation of the changes, ensuring uninterrupted payments.

All the forms you need to get started are available online at HOM, Inc.’s Forms Central page.

Common Questions About Receiving Payments

Property owners often have questions about the payment process, particularly regarding direct deposit. Here are answers to some frequently asked questions to help you feel confident in using this system.

What Happens If My Bank Information Changes?

If you switch banks or update your account details, simply complete a new Direct Deposit Authorization Form with the updated information. Submit the revised form to HOM, Inc., and they will confirm when the changes take effect.

What Documentation Will I Receive with Each Payment?

HOM, Inc. provides a detailed Housing Assistance Payment (HAP) Itemization Report via email or mail. This report includes:

- Payment date and total amount.

- Tenant names and individual payment amounts.

- A description of the payment type (e.g., rent, security deposit).

This transparency ensures you can easily track and reconcile your payments.

Can I Still Opt for Checks Instead of Direct Deposit?

While HOM offers check payments as an option, it’s not recommended. Checks are susceptible to delays, loss, or theft. Additionally, if a check is lost, HOM will not issue a replacement until the 15th of the month, causing unnecessary payment delays.

ACH direct deposit is the most secure and efficient method for receiving payments. You avoid mailing delays, reduce administrative hassles, and gain immediate access to funds on the 1st of each month.

Troubleshooting and Support

While the payment process with Threshold is designed to be smooth and efficient, occasional issues may arise. HOM, Inc. offers comprehensive support to resolve any problems related to receiving payments.

What to Do If a Payment Is Delayed

- Verify Your Direct Deposit Information: Double-check that the bank details provided on your Direct Deposit Authorization Form are accurate.

- Contact HOM, Inc.: If a payment doesn’t arrive on time, reach out to HOM’s support team to investigate the issue. They can confirm whether the payment has been processed or identify potential errors.

Keeping Your Payment Information Up to Date

To ensure uninterrupted payments:

- Notify HOM immediately if your banking details change.

- Submit a new Direct Deposit Authorization Form with the updated information.

HOM’s Dedicated Support Team

HOM’s team is available to assist property owners with any questions or concerns related to payments. Whether you need help setting up direct deposit, understanding your HAP Itemization Report, or resolving a payment issue, HOM provides the guidance you need.

Open communication between property owners and operators and HOM, Inc. is essential. Notify HOM, Inc. promptly of any changes to tenant occupancy, lease agreements, or bank information to avoid disruptions in payments.