On Jan. 1, 2025, Arizona will implement a rental tax ban, abolishing taxes on all rent-related charges. This significant change will reshape the landscape for residential property owners and operators across the state. However, it's important to note that this change will not impact your rental income, just the responsibility to collect rental tax.

Understanding the Rental Tax Ban

The new rental tax ban in Arizona represents a significant shift in how residential property owners and operators conduct business. Under the current law, municipalities impose a tax on rental payments and related charges, such as late fees. However, beginning Jan. 1, all residential property owners and operators will be required to cease the collection of this tax. Here's a deeper look at what this means for you and your rental operations.

Arizona's new rental tax ban, effective Jan. 1, 2025, means residential property owners and operators will no longer collect taxes on rent and related charges.

Key Provisions of the Law

Abolition of Rental Tax: The law eliminates the rental tax on all long-term residential leases. This means that property owners will no longer be allowed to charge a tax on monthly rent, late fees, or any other rent-related charges.

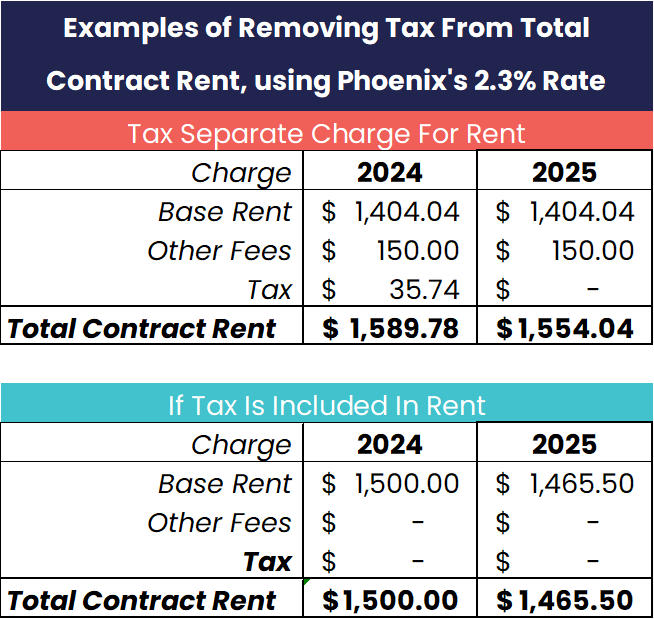

Mandatory Adjustment of Rent: Property owners must adjust the total contract rent amount to reflect the absence of the rental tax. This adjustment applies whether the tax has been collected separately or has been included in the rent amount. The law mandates that tenants should see a decrease in their rent, which means the savings from the tax elimination must be passed on to them.

Impact on Additional Charges: The rental tax ban extends beyond just the rent. Any previously taxable charges, such as late fees, must also be recalibrated to eliminate the tax component. For example, if a late fee was previously $5.00 plus tax, the new charge will simply be $5.00 starting Jan. 1, 2025.

The intention of the new law is to pass these savings in tax cuts to the tenant. The total contract rent amount must show a decrease, regardless of if tax is collected separate to or is included in the base rent. For reference, see the two examples in the table above.

To remove tax from a flat rate rent – or, tax is included in the rent – add 100 to the tax rate then divide by 100. Take the rent amount and divide by this number. The above example is a sample calculation.

Implications for Property Owners and Operators

Compliance Requirements: As a property owner or operator, it's essential to prepare for this change. You must ensure that your billing systems are updated to reflect the removal of the rental tax and that your leases are adjusted accordingly. Non-compliance could lead to serious consequences, including potential lawsuits from tenants and scrutiny from the Attorney General.

Financial Planning: While the rental tax ban may impact municipal budgets, it does not affect your revenue as a landlord. The tax savings, which were once collected on behalf of the state, are now passed directly to tenants. Be sure to plan for potential changes in rent, but rest assured that your overall income will not be reduced by this law.

Communication with Tenants: Open communication with your tenants is crucial. Proactively informing them about the upcoming changes and how it will benefit them can foster goodwill and trust. This can include newsletters, community meetings, or direct emails detailing how their rent will change and emphasizing the positive impact of the tax ban.

Resources for Further Guidance

To help you navigate this transition, various resources are available:

Arizona Multihousing Association (AMA): The Arizona Multihousing Association (AMA) has published a comprehensive blog. It outlines the rental tax ban's implications. The blog offers practical guidance for implementation. It also answers common questions from property operators.

Zona Law Group Podcast: A short podcast episode from the Zona Law Group discusses the specifics of the new law, what changes need to be made, and the potential consequences of non-compliance.

Read the Bill: Senate Bill 1131 lays out the changes in Arizona Revised Statutes Sections 9 and 11 that go into effect on Jan. 1, 2025.

These resources can serve as valuable tools as you prepare for the upcoming changes and ensure a smooth transition to the new rental tax structure. Understanding these key provisions and their implications will position you for success as the rental tax ban approaches.

With the rental tax ban deadline approaching, property owners and operators must prepare to ensure smooth compliance and minimal disruption.

Preparing for the Transition

As the deadline for the rental tax ban approaches, property owners and operators need to take proactive steps to ensure compliance and minimize disruption. Below are essential strategies to help you navigate this transition effectively.

Adjusting Lease Agreements

Review Existing Leases: Begin by reviewing all current lease agreements to identify any references to the rental tax. Ensure that existing leases are compliant by removing any mention of the tax.

Drafting New Leases: For all new leases initiated on or after Jan. 1, 2025, ensure that they do not include any references to rental tax. This means creating new lease templates that clearly state the rental amount without any tax implication. Working with legal professionals or your CPA can help you draft these agreements accurately.

Communicating Changes to Tenants: Notify your tenants about the changes to their lease agreements, particularly if they are currently in a lease that includes rental tax. Transparency is key; provide a clear explanation of how their rent will change and the overall benefits of the tax ban.

Updating Billing and Payment Systems

Modify Billing Procedures: Update your billing systems to reflect the new rental amounts without the tax component. Ensure that all software or manual billing practices are adjusted accordingly.

Implementing New Fee Structures: Evaluate any additional charges (e.g., late fees, pet fees) that were previously subject to the rental tax. Ensure these fees are recalibrated to exclude any tax components.

Financial Record-Keeping: Maintain accurate records of the adjustments made to rents and fees for auditing and compliance purposes. Keeping thorough documentation will help protect your interests in case of disputes or inquiries regarding compliance with the new law.

Engaging with Legal and Financial Advisors

Consulting Professionals: Given the legal and financial implications of the rental tax ban, consulting with legal and financial advisors is crucial. They can provide guidance on how to implement these changes effectively and ensure that your operations comply with the law.

Understanding Tax Implications: Speak with your CPA about any potential tax implications of the rental tax ban on your business. This includes understanding how the elimination of the tax may affect your overall revenue and expense reporting.

Staying Informed: Stay updated on any changes to the law or additional guidance provided by the Arizona government or property management associations. Regularly check resources like the Arizona Multihousing Association and other industry groups to remain informed of best practices and compliance requirements.

Leverage the rental tax ban to attract and retain tenants by showcasing reduced rent and fees, making your properties more affordable.

Promoting the Benefits to Tenants

Marketing the Change: Use the rental tax ban as a marketing tool to attract and retain tenants. Highlight the reduction in rent and related fees as a positive development that enhances affordability in your properties.

Building Community Relations: Engage with your tenants through community meetings or newsletters to discuss the rental tax ban and its benefits. This fosters a sense of community and reassures tenants that their landlord is committed to transparency and fairness.

Encouraging Feedback: After communicating the changes, invite tenant feedback regarding their experiences with the new rental amounts. This feedback can provide valuable insights into tenant satisfaction and highlight areas for further improvement in your property management practices.

By taking these proactive measures, property owners and operators can ensure a smooth transition into the new rental tax landscape. Preparing early will not only help you comply with the law but also position your properties as desirable places to live in an evolving market.

Navigating the Market Post-Ban

Assessing Rental Market Trends

Conducting Market Analysis: Start by conducting a thorough analysis of the local rental market. Research current rental rates, occupancy levels, and tenant demographics. Understanding these trends will help you set competitive rent prices that attract tenants while ensuring profitability.

Identifying Target Tenants: Identify the demographics of potential tenants who are likely to benefit from the rental tax ban, such as young professionals, families, or retirees. Tailor your marketing strategies to appeal to these groups, highlighting the affordability and value of your properties.

Adjusting for Inflation and Market Fluctuations: Keep an eye on inflation rates and other economic indicators that may affect rental prices and tenant demand. Being aware of these factors will allow you to make informed decisions about rent increases or adjustments in the future.

Enhancing Property Appeal

Investing in Upgrades and Maintenance: To remain competitive, consider investing in property upgrades and routine maintenance. Enhancements such as modern appliances, energy-efficient fixtures, and updated interiors can increase the desirability of your units and justify rent prices.

Improving Amenities: Evaluate the amenities offered at your properties and consider adding features that are attractive to tenants, such as fitness centers, community spaces, or outdoor areas. Amenities can significantly enhance tenant satisfaction and retention.

Fostering a Sense of Community: Promote community engagement through events or programs that encourage tenant interaction. Building a strong sense of community can lead to increased tenant satisfaction and loyalty, reducing turnover rates.

Stay ahead in the changing rental landscape by staying informed on new regulations. Regularly review compliance to avoid potential penalties.

Adapting Marketing Strategies

Highlighting Cost Savings: In your marketing efforts, emphasize the financial benefits of the rental tax ban. Promote how the removal of the tax translates to lower overall rental costs for tenants, making your properties more attractive compared to others still charging tax.

Utilizing Digital Marketing: Leverage digital marketing platforms to reach potential tenants effectively. Use social media, property listing websites like Padmission Connect, and email marketing to showcase your properties. Highlight the benefits of living in a tax-free environment.

Gathering and Showcasing Reviews: Encourage current tenants to leave positive reviews online. User-generated content can significantly influence prospective tenants' decisions. Showcase testimonials that highlight the affordability and quality of living in your properties.

Monitoring and Adapting to Future Changes

Staying Compliant with Regulations: As the rental landscape evolves, ensure that you stay informed about any new regulations or changes in local laws. Regularly review compliance requirements to avoid potential penalties.

Adjusting Business Strategies: Be prepared to adapt your business strategies based on market feedback and economic conditions. Flexibility is crucial in responding to shifts in tenant preferences or market demands.

Seeking Ongoing Education: Participate in industry seminars, webinars, and networking events to stay updated on best practices and emerging trends in property management. Continuous education will help you maintain a competitive edge in the market.

By strategically navigating the rental market post-ban, property owners and operators can create a thriving environment for tenants while maximizing their investment potential. Embracing change and focusing on tenant satisfaction will ultimately lead to long-term success in the evolving landscape of Arizona's rental properties.